Oregon's Department of Social and Human Services (DSHS) ensures children's financial security post-divorce through a robust support payment process. This begins with a court-ordered plan considering parental incomes and the child's needs. Legal enforcement mechanisms, including wage garnishment and driver's license suspensions, are employed by the state to collect payments. Non-compliance incurs penalties, while resources are available to assist parents in adhering to orders. The Oregon Department of Human Services (DHS) Division of Child Support is tasked with enforcing these payments, utilizing guidelines and legal frameworks to ensure compliance, with consequences for non-payment, including wage deductions and criminal penalties.

In Oregon, enforcing child support payments is a multifaceted process designed to ensure financial security for children. This article guides you through the intricate web of Oregon’s support enforcement laws, offering insights into understanding and navigating this system. From initial determinations and collection methods to legal strategies and parental rights, we demystify each step of the support payment process. Equip yourself with knowledge to enforce support payments legally in Oregon, ensuring a stable future for your children.

- Understanding Oregon's Child Support Enforcement Laws

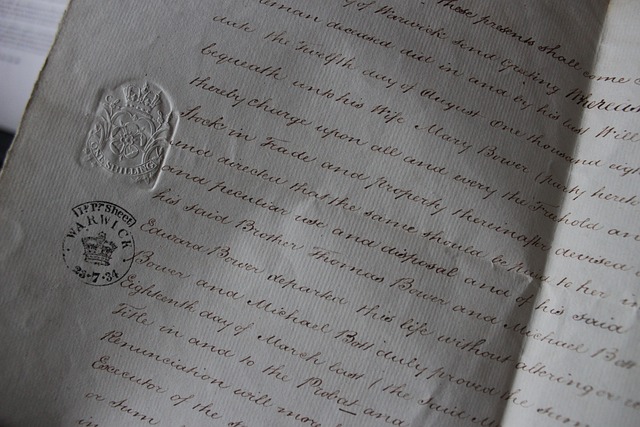

- – Overview of legal framework

- – Key regulations and rules

- The Support Payment Process in Oregon

Understanding Oregon's Child Support Enforcement Laws

In Oregon, the enforcement of child support payments is a strictly regulated process aimed at ensuring financial stability for children after a divorce or separation. The state’s Department of Social and Human Services (DSHS) plays a pivotal role in administering and enforcing these laws. The support payment process begins with the creation of a child support order, which outlines the amount and timing of payments. This order is based on factors such as both parents’ incomes, the time each parent spends with the child, and the child’s needs.

Oregon’s legal support enforcement mechanisms include various tools to ensure compliance, such as wage garnishment, tax refunds, and driver’s license suspension. If a parent falls behind on payments, they may face administrative penalties, including increased payment amounts due to interest or late fees. The state also offers resources for parents to resolve issues and make payments more manageable through plans tailored to their financial situations.

– Overview of legal framework

In Oregon, the process of enforcing child support payments is governed by a robust legal framework designed to ensure financial stability for children after a divorce or separation. The state’s Department of Revenue plays a pivotal role in administering and collecting child support, utilizing various methods to enforce support payments. This includes income withholding, where employers are mandated to deduct specified amounts from non-custodial parents’ paychecks and remit them directly to the Oregon Department of Revenue.

The legal support enforcement process involves several steps, beginning with the establishment of a child support order by a court. This order outlines the amount and timing of payments, as well as any associated terms. Non-compliance with these orders can trigger enforcement actions, such as license suspension, wage garnishment, or even jail time for willful refusal to pay. Oregon’s support enforcement agency actively monitors and pursues these payments, ensuring that children receive the financial support they require for their well-being.

– Key regulations and rules

In Oregon, enforcing child support payments is governed by a series of key regulations and rules designed to ensure that children receive the financial support they need from their parents or legal guardians. The Oregon Department of Human Services (DHS) plays a pivotal role in facilitating this process through its Division of Child Support. This division administers the state’s support enforcement program, ensuring compliance with both federal and state laws. The support payment process involves several steps, including the establishment of a child support order, verification of employment and income, and regular reporting to maintain accuracy in payments.

Legal support enforcement in Oregon is driven by a comprehensive framework that includes guidelines for determining child support amounts, procedures for modifying orders, and strategies for managing non-compliance. Parents or guardians are expected to make timely and full payments as per the established order. Failure to comply can result in various consequences, such as wage garnishment, tax refunds being directed towards support payments, or even criminal penalties in cases of willful non-payment. The Oregon DHS offers resources and assistance to both paying parents and those seeking support, ensuring that the process is fair, transparent, and effective.

The Support Payment Process in Oregon

In Oregon, enforcing support payments is a meticulous process designed to ensure financial responsibility for children’s well-being. It begins with an order established by a court, which outlines the amount and timing of child support payments. This legal document serves as a binding agreement between the non-custodial parent (the one who does not have primary physical custody) and the custodial parent or parents. Once the order is in place, Oregon’s Department of Consumer and Business Services (DCBS) takes on a crucial role in support enforcement.

The DCBS uses various methods to enforce support payments legally, including wage garnishments, bank account levies, and tax refunds offsets. They collaborate with employers and financial institutions to ensure that the non-custodial parent’s income is applied towards their legal obligations. Should the parent fail to comply with the support order, the DCBS can take further action, such as issuing warrants or referring the case to a collection agency. This process aims to protect the interests of the child by guaranteeing a consistent and lawful flow of financial support.